Shareholders of Montrose would probably like to forget the past six months even happened. The stock dropped 42.7% and now trades at $16.68. This may have investors wondering how to approach the situation.

Following the drawdown, is now the time to buy MEG? Find out in our full research report, it’s free.

Why Does MEG Stock Spark Debate?

Founded to protect a tree-lined two-lane road, Montrose (NYSE:MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

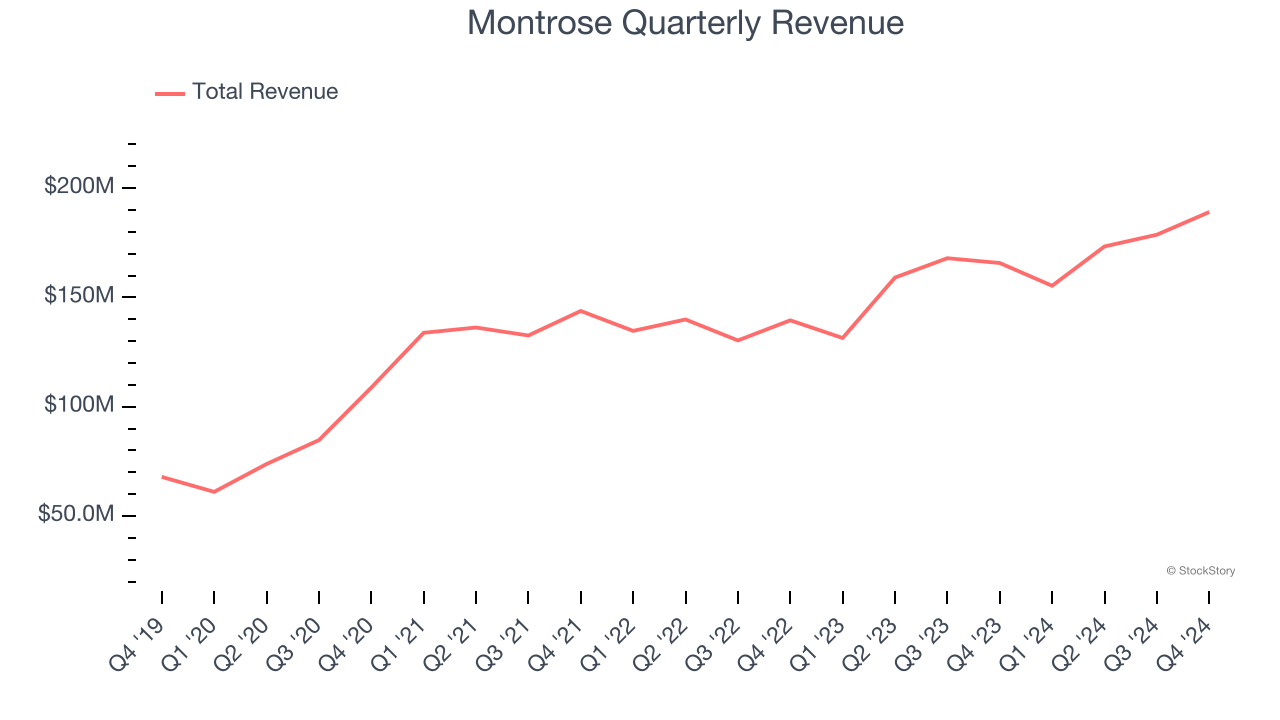

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Montrose’s 24.4% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

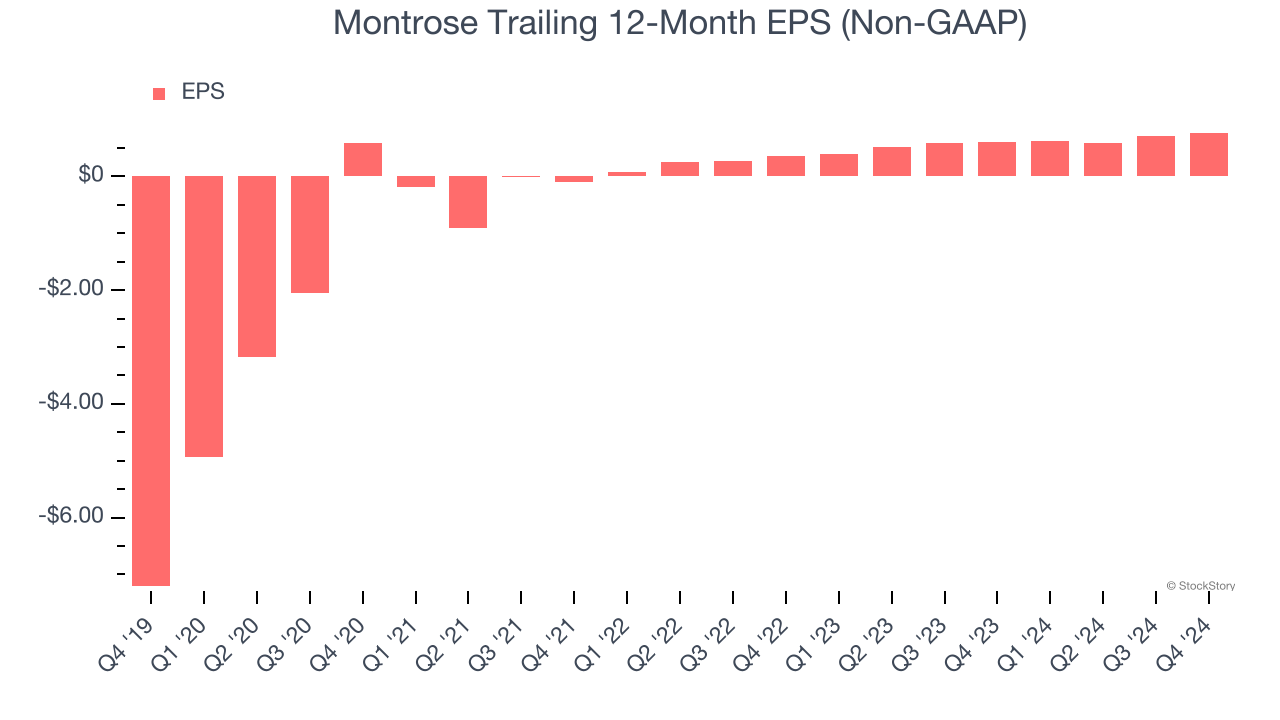

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Montrose’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

Core Business Falling Behind as Demand Plateaus

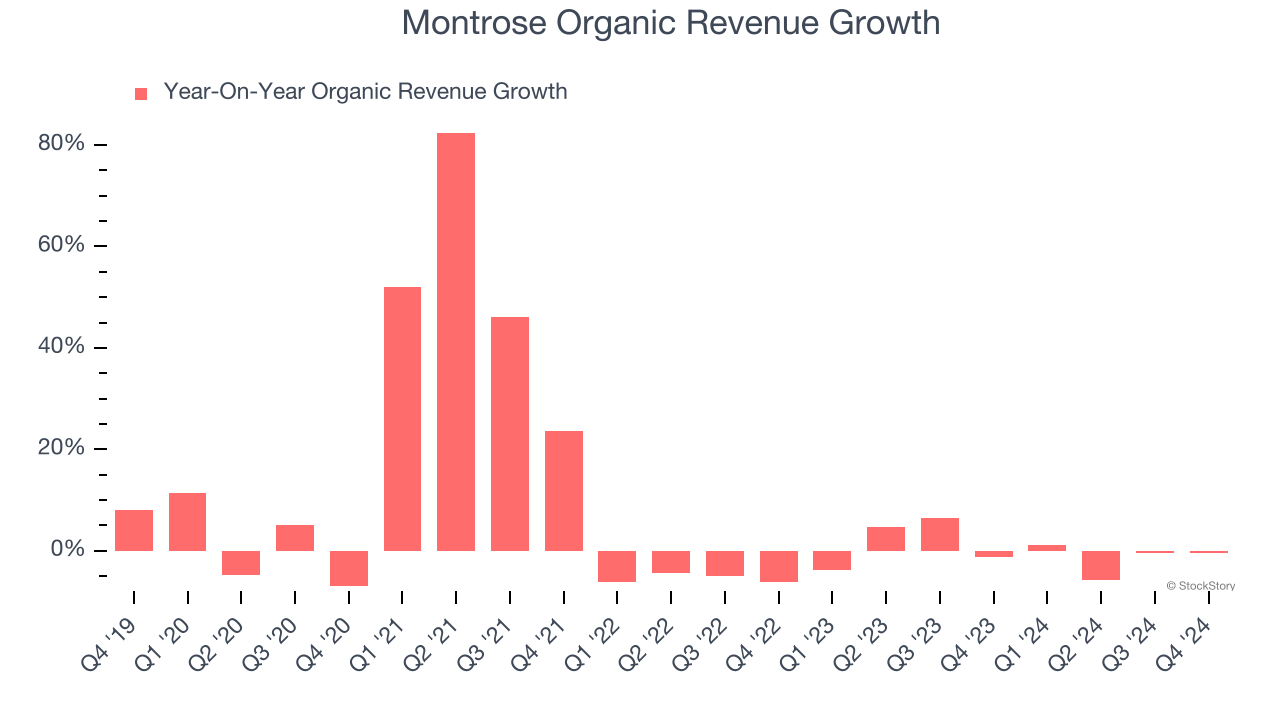

We can better understand Waste Management companies by analyzing their organic revenue. This metric gives visibility into Montrose’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Montrose failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Montrose might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

Final Judgment

Montrose has huge potential even though it has some open questions. With the recent decline, the stock trades at 19.6× forward price-to-earnings (or $16.68 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Montrose

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.