Over the last six months, MGM Resorts’s shares have sunk to $35.20, producing a disappointing 5.3% loss - a stark contrast to the S&P 500’s 10.1% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in MGM Resorts, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think MGM Resorts Will Underperform?

Even though the stock has become cheaper, we're swiping left on MGM Resorts for now. Here are three reasons you should be careful with MGM and a stock we'd rather own.

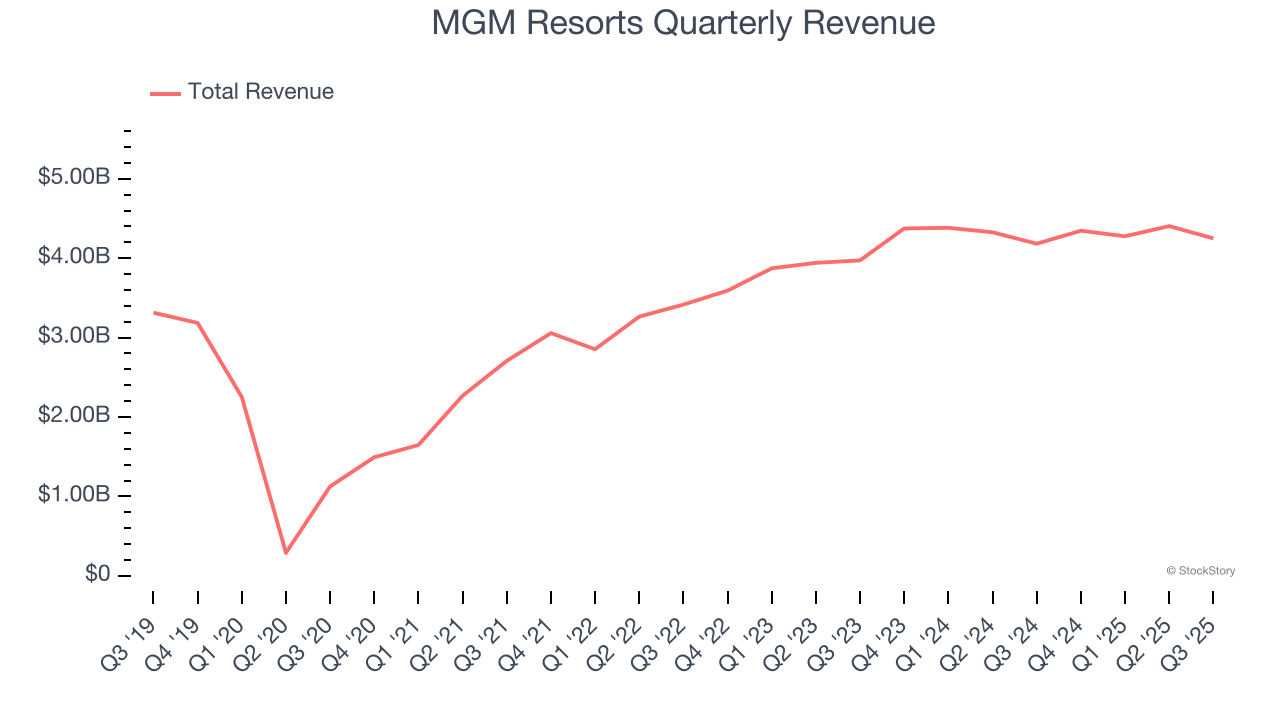

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, MGM Resorts grew its sales at a 20.3% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

2. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, MGM Resorts’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

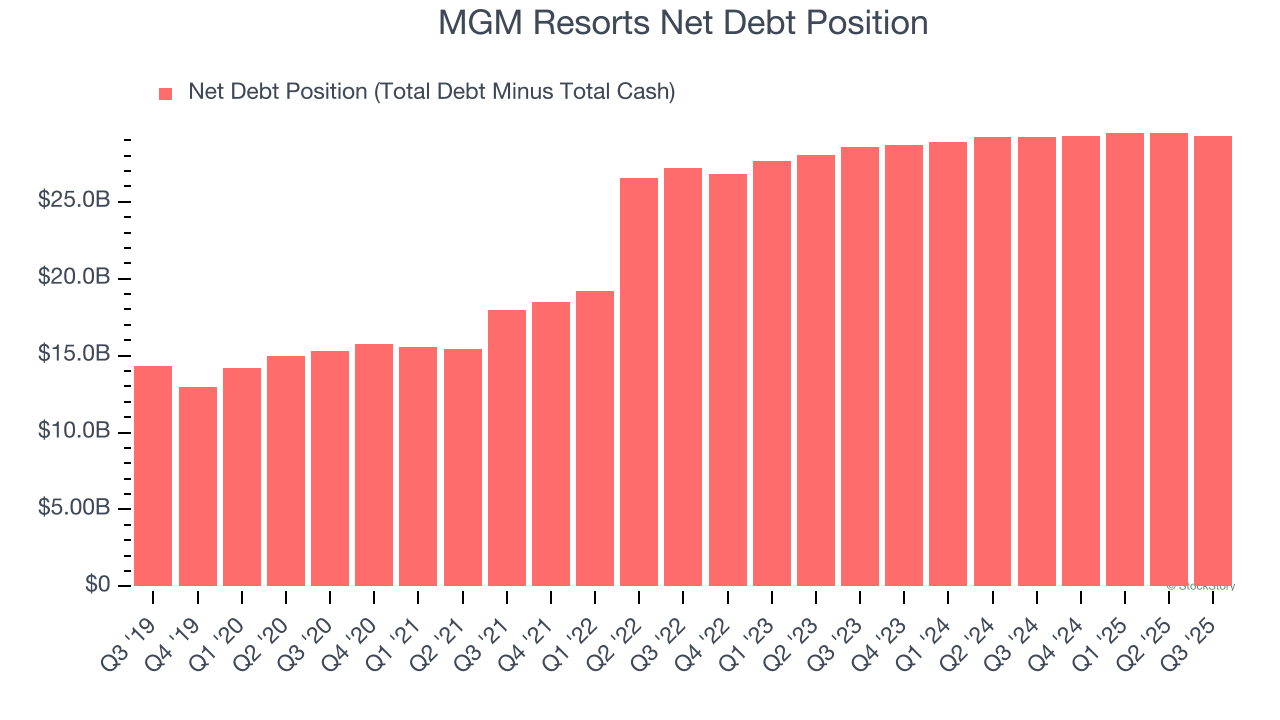

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

MGM Resorts’s $31.42 billion of debt exceeds the $2.13 billion of cash on its balance sheet. Furthermore, its 13× net-debt-to-EBITDA ratio (based on its EBITDA of $2.32 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. MGM Resorts could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope MGM Resorts can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

MGM Resorts falls short of our quality standards. Following the recent decline, the stock trades at 16.2× forward P/E (or $35.20 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of MGM Resorts

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.